From the viewpoint of a Forex market observer one would find themselves at the perimeter surrounded by data tables that simulate a chaotic high-stakes poker table. Montreal Casino veterans use instinct and skills as their tools just like professional Forex traders utilize their own instruments to treat these unpredictable markets. Bollinger Bands serve as a technical indicator which enables you to detect possible market shifts. This article explains Bollinger Bands usage in Forex strategies without limitations to trading experience level.

What Are Bollinger Bands?

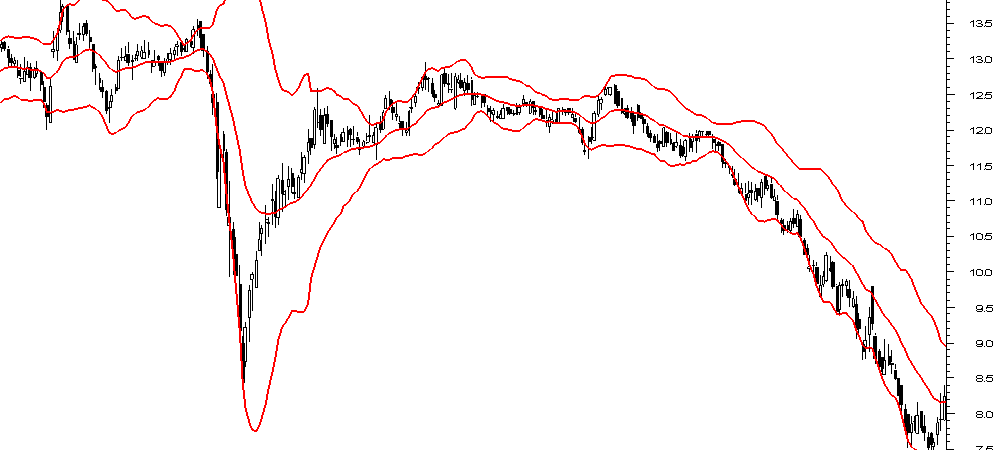

Bollinger Bands stand as a widely adopted indicator which finds extensive application among those who operate in Forex trading markets. But what exactly are they? The three fundamental bands in Bollinger Bands include the middle band and both the upper and lower bands. Market movements reveal important information through the three important bands that form Bollinger Bands.

Components of Bollinger Bands

- The upper band represents the tallest portion of the bands by calculating both moving averages and using standard deviation measure from the mean level.

- The lowest band located beneath the moving average matches its calculation method with the upper band.

- The middle band functions usually as a baseline with a 20-day simple moving average (SMA) that serves as reference for upper and lower bands.

The bands create together a visual depiction of market volatility through their placement. The amount of volatility shows by how much the bands extend from each other. Lower volatility appears in the market when these bands narrow down. The flexible nature of Bollinger Bands is among the features that draw traders to use them.

How Do Bollinger Bands Adapt to Market Volatility?

Imagine driving a car. The smoother the road conditions become the faster you should drive. An uneven road causes traders to reduce their speed. Bollinger Bands work similarly. Market conditions trigger their size variations through expansion and contraction. The range of the bands expands while market volatility exists because this increased visibility helps traders monitor potential price fluctuations. The market tranquility causes bands to constrict indicating price stability. The feature lets you measure market volatility intensities between high and low points. Using the information is vital to generate informed trading decisions. The way you would utilize this data requires further clarification. The position of the bands allows you to detect trade entry and exit opportunities.

The Role of Standard Deviations

Standard deviations serve as fundamental components for Bollinger Bands implementation. Standard deviations provide traders with information about the distance of prices from their normal average position. Standard deviations provide an essential indication of how prices distribute their values across the price range. Price distribution becomes wider with increased standard deviation yet a lower standard deviation indicates prices stay nearer to each other. Most traders establish Bollinger Bands from a 20-day moving average combined with two standard deviations. The combination of moving average with standard deviations shows traders clear movement patterns. Bollinger Bands exist to monitor volatility and price movement according to the words of their originator John Bollinger. The concepts help traders improve their use of Bollinger Bands within their trading plan. Market sentiment analysis becomes easier through these chart lines which function as meaningful informational tools. The Bollinger Bands serve as an adaptable instrument for traders to use. Price patterns show relative price positions between high and low ranges. This knowledge proves essential for proper evaluation of market sentiments. Understanding how Bollinger Bands function will provide a better trading experience for both veteran and beginner professionals. Bollinger Bands serve as one of the main trading tools which Forex market participants actively use. With Bollinger Bands you can easily understand market price sensitivity and price fluctuations. What are the proven strategies to integrate Bollinger Bands into your current framework? Here are some practical tips.

1. Combine with Other Indicators

Bollinger Bands will perform better in your decision process when combined with other indicators. The trading strategy benefits from combining Bollinger Bands with the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD).

- The RSI provides quantitative data on price movement speed together with its changes. Using Bollinger Bands together enables traders to verify market conditions of overbought and oversold states.

- The MACD provides essential indications about momentum variations. Both indicators provide additional confirmation when their signals cross with those of the Bollinger Bands.

Combining these indicators enables you to select trading options with better information. Bollinger Bands work similar to using both maps and compasses. Both tools independently lead traders yet when combined they establish a representative course for the market.

2. Identify Reversal Points and Breakouts

Bollinger Bands function as exceptional tools for detecting upcoming reversals alongside market breakouts within the Forex market radius. The price touching the upper band indicates market conditions that are considered overbought. A market signals over-selling when the price touches the lower band.

Bollinger Band signals serve as important indicators to help traders decide about entering or exiting their trades. The indicators fail to work at all times. You should constantly analyze the wider market elements when making trading decisions. Does the current market have any upcoming major news events? Does the market news indicate upcoming price changes?

3. Understand Market Context

The interpretation of Bollinger Band signals depends strongly on your market news understanding. Major economic reports which create swift price fluctuations serve as an example for this statement. The price bands become highly expansive under such market conditions as volatility rises.

The ability to stay updated enables necessary modifications of your trading strategy. Technicals should not be your sole strategy since news requires assessment for proper trading decisions.

4. Recognize Trading Opportunities

The price of a financial instrument will move between its bands during 80% of its trading activity. This signifies numerous trading opportunities. The price movement beyond these bands usually suggests both brand-new trend direction and continued price movement.

However, don’t jump in blindly. Always analyze the situation. Analyze if the price leaves the bands because genuine market forces are at play or because of passing volatility. A trader needs to adopt an awareness of market volatility in order to succeed with Bollinger Bands. – Expert Trader When trading you should prepare actively for unexpected market shifts because they are an unavoidable part of business. The trading game naturally includes this factor. Your trade performance will improve when you maintain composure by accepting volatile market conditions.

5. A Holistic Approach

Bollinger Bands let you identify critical patterns that indicate potential trading opportunities when used as a part of trading strategy. Bollinger Bands serve to enhance a total system for Forex trading. The combination with other tools and market condition awareness allows traders to reach higher levels of trading effectiveness. Are you set to include Bollinger Bands in your trading method? The tool requires practice along with patience for users to develop mastery that will enhance their trading success. The volatility indicator called Bollinger Bands attracts widespread adoption by traders across the markets. Bollinger Bands enable traders to monitor market fluctuations that might lead to price alterations. Bollinger Bands may cause errors when used extensively without proper attention to other factors. Mastering your trading path requires knowledge about typical mistakes which you face.

1. Over-Reliance on Bollinger Bands

Traders fail most prominently when they place complete trust in Bollinger Bands alone. Bollinger Bands supply significant insights but do not cover everything. You must understand market fundamentals. Lacking market fundamentals will make you misread important signals. A price touch on the upper band might lead someone to believe it is the right time to sell. A strong uptrend in the market makes the demand for Bollinger Bands interpretations questionable. Trading at this point would potentially result in leaving behind additional money in the market. Putting excessive faith in Bollinger Bands might result in financial losses for the trader.

2. Ignoring Context

The consistent monitoring of Bollinger Bands signals while factoring in their point of origin remains a typical mistake for traders. Market volatility determines the range of movements that Bollinger Bands make. Assess other relevant market factors whenever a price breaks through a band. The current situation of the broad market deserves examination. Does current news situation affect price activity?

Such failure to consider these elements represents a major loss of business potential. A price rising through the upper band level presents itself as a likely moment to start purchasing. The market bearishness can produce misleading signals that should be evaluated carefully. Always analyze the bigger picture.

3. Maintaining a Dynamic Approach

The key element in trading success requires a flexible system. Following Bollinger Bands signals strictly ensures sub-optimal results. Markets change constantly. Previous strategies which brought success can no longer bring results in the present. Adaptation is key to success.

Trading operations can be best summarized as a process of perpetual fluctuation according to the words of this financial expert. A successful trading approach requires constant adaptations when using Bollinger Bands according to this expert source.

4. Continuous Learning and Adjustment

Success in trading requires constant education. Apply strategy changes derived from your ongoing learning process. The survey shows that traders who fail to grasp Bollinger Bands correctly reach 60% because they lack full market understanding. Join the group of traders who prevent leaving data behind.

Devote your time to obtain complete understanding of the topic. Get knowledge through reading educational books and participating in webinars alongside following relevant market information. When you accumulate knowledge you will obtain better abilities to make smart decisions.

Conclusion

Being aware of typical mistakes when working with Bollinger Bands demands the same effort as mastering their proper implementation. Awareness about these market conditions will defend your financial investments while improving trading method effectiveness. The successful application of Bollinger Bands in your trading requires cautious dependence while accounting for situations and flexible planning alongside regular skill development. Successfully trading requires more than tools because complete market comprehension stands as the fundamental element in Forex trading success.